Batter Links: Your Gateway to Trending News

Stay updated with the latest trends and insights from around the world.

Discounts Like You’ve Never Seen: How to Slash Your Auto Insurance Costs

Uncover shocking secrets to slash your auto insurance costs! Discover discounts that will leave you amazed and save you big.

Top 5 Discounts You Might Be Missing on Your Auto Insurance

Auto insurance can be a significant expense, but many drivers are unaware of the discounts available to them. To help you save money, we’ve compiled a list of the top 5 discounts you might be missing on your auto insurance. Understanding these discounts can not only lower your premiums but also ensure you're getting the best coverage for your needs.

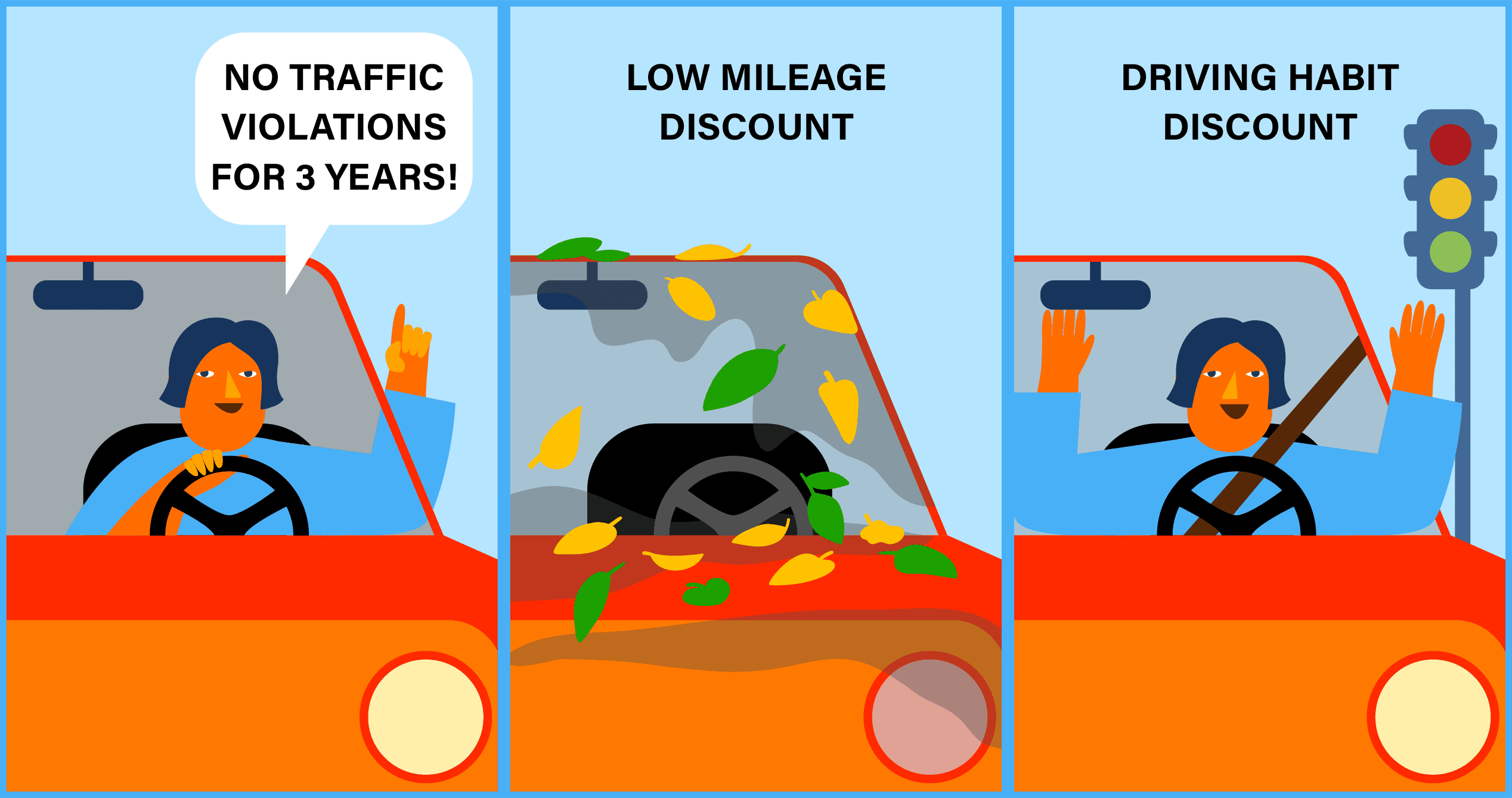

- Safe Driver Discounts: If you maintain a clean driving record free from accidents and traffic violations, you might qualify for a safe driver discount. Insurance companies reward responsible drivers with reduced rates.

- Bundling Discounts: Consider combining your auto insurance with other policies, like home or renters insurance. Many providers offer substantial discounts for bundling multiple policies.

- Low Mileage Discounts: If you drive less than average, you may be eligible for a low mileage discount. Reporting your actual mileage could save you money on your premium.

- Good Student Discounts: Full-time students with good grades often qualify for discounts, acknowledging their responsible behavior both academically and behind the wheel.

- Vehicle Safety Features: Cars equipped with advanced safety features such as anti-lock brakes, airbags, and anti-theft devices can help you snag a better rate.

How to Compare Quotes and Maximize Your Auto Insurance Savings

When it comes to maximizing your auto insurance savings, comparing quotes from multiple providers is essential. Start by gathering at least three quotes from different insurance companies to gain a comprehensive understanding of your options. To streamline this process, create a checklist that includes important factors such as coverage limits, deductibles, and additional discounts. This systematic approach will not only help you visualize the differences in coverage but also enable you to make an informed decision about which policy best suits your needs.

While comparing the quotes, pay close attention to the premium costs as well as the coverage offered. It's important to look beyond the price; ensure that the policy provides adequate protection against potential risks. Additionally, consider factors like customer service reputation and claims handling efficiency. By carefully evaluating your options and prioritizing both savings and value, you can significantly enhance your auto insurance experience and ensure that you're getting the best deal possible.

Are You Eligible for These Hidden Auto Insurance Discounts?

When it comes to auto insurance, many drivers are unaware of the hidden discounts available to them. These discounts can significantly lower your premium without compromising your coverage. For instance, many insurance companies offer discounts for features such as anti-theft devices, safe driving records, and even bundle discounts for purchasing multiple policies. It’s essential to explore all available options and ask your insurer about any programs they may offer to help you save on your auto insurance.

Additionally, don't overlook factors like good student discounts or low mileage discounts. If you're a student maintaining a high GPA, your insurer may provide financial incentives. Similarly, if you drive less than the average number of miles per year, you might qualify for lower rates due to reduced risk. Always communicate openly with your provider about your circumstances, as these hidden auto insurance discounts can lead to substantial savings over time.