Batter Links: Your Gateway to Trending News

Stay updated with the latest trends and insights from around the world.

Why Paying Less for Insurance Doesn't Have to Mean Sacrificing Coverage

Discover how to save on insurance without compromising coverage! Unlock the secrets to affordable protection today!

How to Find Quality Insurance at a Lower Cost

Finding quality insurance at a lower cost can seem daunting, but it's entirely achievable with the right approach. Start by comparing quotes from multiple providers. Use online comparison tools that aggregate prices and coverage options to help you identify the best deals. Don’t forget to assess each policy's coverage limits and deductibles, as the cheapest option may not always provide adequate protection. As you evaluate your options, consider factors such as the insurer's financial stability and customer service ratings to ensure you are choosing a reputable provider.

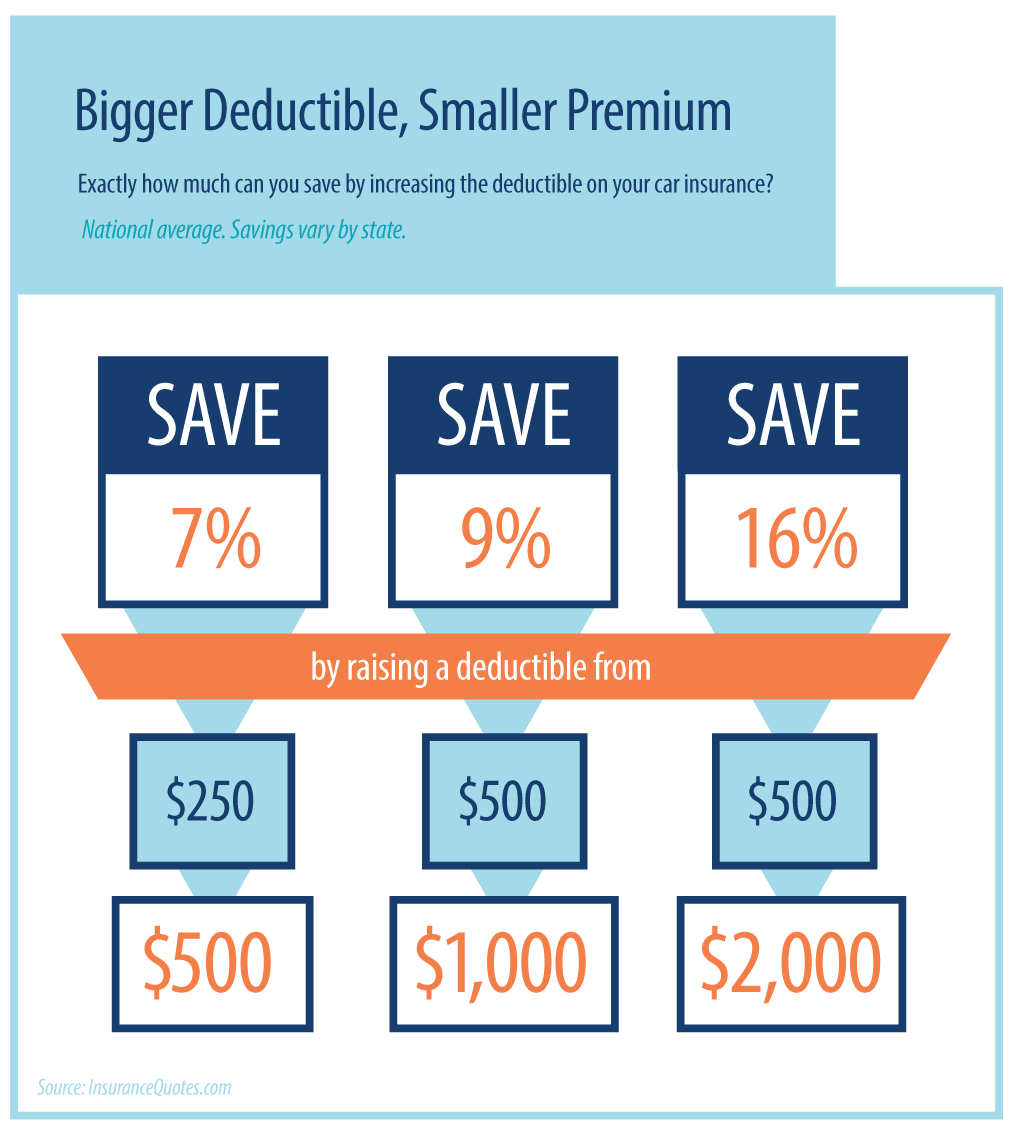

Another effective strategy for securing quality insurance at a lower cost is to take advantage of discounts. Many insurers offer various discounts for things like bundling policies, maintaining a good driving record, or being claim-free. You might also explore loyalty discounts if you stay with the same insurer for an extended period. Additionally, consider adjusting your coverage limits and increasing your deductible; these actions can significantly lower your premium while still providing adequate protection for your needs.

The Myth of Cheap Insurance: Understanding Coverage vs. Price

The world of insurance can often be deceiving, particularly when it comes to the myth of cheap insurance. Many consumers are tempted to choose policies based solely on price, assuming that lower premiums equate to better deals. However, this approach frequently overlooks critical aspects of coverage. When evaluating an insurance policy, it's essential to understand the difference between the cost of premiums and the quality of coverage provided. A policy with a seemingly low price may lack adequate support, exclusions, or high deductibles, leading to significant out-of-pocket expenses when a claim arises.

To truly grasp the relationship between coverage and price, consider the old adage: "You get what you pay for." Opting for a cheap insurance policy can result in inadequate protection, leaving you vulnerable during a crisis. It is crucial to assess what is included, such as liability limits, deductibles, and additional benefits. Creating a balanced view requires evaluating both short-term affordability and long-term value. Prioritizing comprehensive coverage over merely low cost can ultimately save you money, stress, and hassle if you ever need to file a claim.

Top Tips for Balancing Cost and Coverage in Your Insurance Policies

Finding the right balance between cost and coverage in your insurance policies is crucial for peace of mind and financial security. Consider evaluating your needs thoroughly before choosing a policy. Start by listing the essential coverage areas such as health, auto, or home insurance, and then determine how much you can afford to pay for premiums. Compare multiple insurance providers and their policies to ensure you are not sacrificing essential coverage for the sake of lower costs. Remember, a cheaper policy may result in higher out-of-pocket expenses in the long run, so weigh your options carefully.

Additionally, review your policies regularly to ensure they still meet your changing needs. Life events like marriage, having children, or buying a home can significantly impact the type and amount of coverage you require. Don't hesitate to ask your insurance agent about discounts for bundling policies, maintaining a good driving record, or improving your home security, as these can all contribute to reducing costs while maintaining adequate coverage. By staying proactive, you can achieve a healthy balance between cost and coverage that protects you without breaking the bank.