Batter Links: Your Gateway to Trending News

Stay updated with the latest trends and insights from around the world.

Term Life Insurance: The Silent Superhero of Your Financial Plan

Unlock the hidden power of term life insurance and discover how it can be the secret hero of your financial strategy!

Understanding Term Life Insurance: Key Benefits for Your Financial Security

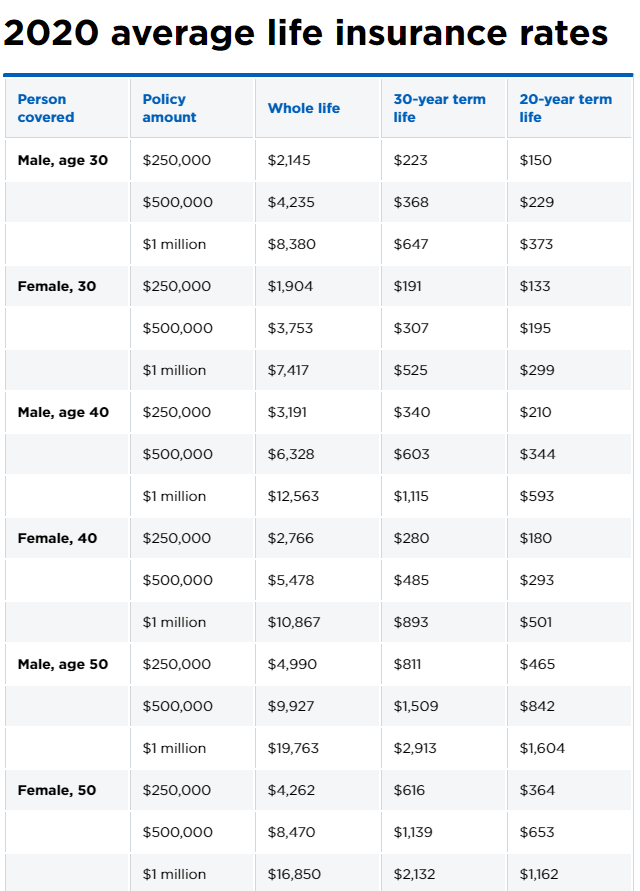

Term life insurance offers a straightforward way to secure your financial future, making it an essential component of many families' financial planning. Unlike permanent life insurance, term life provides coverage for a specified duration—typically ranging from 10 to 30 years. This type of policy is designed to pay a death benefit to your beneficiaries in case of your untimely passing, ensuring their financial security during a critical period. One of the main benefits of term life insurance is its affordability; premiums are generally lower compared to whole life policies, allowing you to allocate your budget more effectively while still protecting your loved ones.

Another key advantage of term life insurance is its flexibility. Policyholders have the option to choose the coverage term that best suits their needs—be it for a growing family, a mortgage, or future educational expenses. Furthermore, many term policies offer conversion options, enabling you to switch to a permanent plan without requiring a medical exam. This adaptability ensures that as your financial situation evolves, your insurance policy can be adjusted to maintain your family's financial security. Overall, understanding the benefits of term life insurance is crucial for anyone looking to bolster their financial security.

Is Term Life Insurance Right for You? 5 Questions to Ask

Deciding whether term life insurance is right for you can be a crucial step in ensuring your family's financial security. To help you navigate this decision, consider asking yourself these five questions:

- How long do I need coverage? Assess your financial responsibilities, such as mortgage payments and children's education, to determine the appropriate term length.

- What is my budget? Understanding how much you can allocate for premiums will help you choose a plan that aligns with your financial situation.

- Do I have dependents? If you have loved ones relying on your income, term life insurance can provide necessary support in the event of your passing.

- What are my health conditions? Consider how your health history may affect your eligibility and premiums.

- What are the potential benefits? Evaluate the peace of mind that comes with knowing your family is financially protected during the term of the policy.

How Term Life Insurance Can Safeguard Your Family's Future

Term life insurance is a critical financial tool designed to provide your family with a safety net in the event of an untimely death. By securing a policy that aligns with your family's needs, you ensure they have the necessary funds to cover living expenses, debts, and educational costs. In fact, many financial advisors recommend term life insurance as it is typically more affordable than permanent life insurance, making it an accessible option for families on a budget.

When considering how term life insurance can safeguard your family's future, it's essential to evaluate the policy's coverage amount and duration. For instance, you might choose a policy that covers your income for 10, 20, or even 30 years, offering peace of mind as you work towards building a stable future for your loved ones. In summary, investing in term life insurance is not just a financial decision; it's a promise to protect your family's well-being in times of uncertainty.