Batter Links: Your Gateway to Trending News

Stay updated with the latest trends and insights from around the world.

Cash in a Flash: The Rise of Instant Payout Systems

Discover how instant payout systems are revolutionizing cash flow and changing the game for businesses and consumers alike. Don't miss out!

How Instant Payout Systems are Revolutionizing Financial Transactions

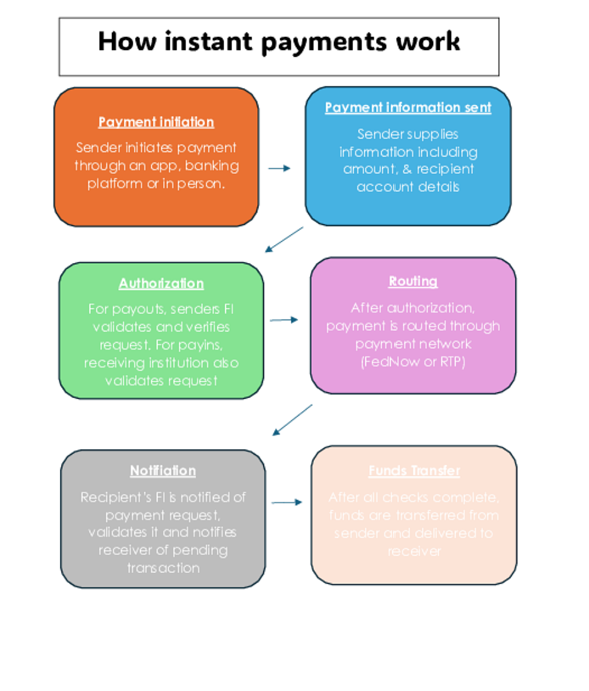

The advent of instant payout systems has significantly transformed the landscape of financial transactions. These systems enable users to receive payments within minutes, or even seconds, thereby eliminating the traditional delays associated with bank transfers and payment processing. For businesses, this means improved cash flow and enhanced customer satisfaction, as clients can enjoy quicker access to their funds. As more companies adopt these technologies, the demand for faster and more efficient payment solutions continues to rise, marking a critical shift in how transactions are conducted.

One of the key advantages of instant payout systems is their accessibility, empowering users to manage their finances with greater ease and flexibility. Whether it’s freelancers getting paid for their work or small businesses settling invoices, the ability to access funds immediately can lead to better financial management. Moreover, these systems often integrate seamlessly with various e-commerce platforms, enabling users to transfer money across different channels effortlessly. As the market continues to evolve, embracing instant payment solutions will become essential for both consumers and businesses striving for efficiency and convenience.

Counter-Strike is a popular first-person shooter (FPS) game that pits teams against each other in various objective-based scenarios. The game's strategic gameplay and competitive nature have created a robust esports scene. For players looking to enhance their experience, consider using a clash promo code to unlock exciting features and rewards.

Understanding the Benefits and Risks of Instant Payout Technologies

Instant payout technologies have become increasingly popular among businesses and freelancers, offering significant advantages such as improved cash flow and greater flexibility in managing finances. With these systems, users can receive their earnings in real-time, allowing them to meet immediate financial needs and reinvest in their businesses without delay. This enhanced liquidity can foster greater productivity and satisfaction, as individuals are empowered to access their funds as soon as they are earned. Additionally, instant payouts can facilitate better financial planning, enabling users to allocate resources promptly and efficiently.

However, it is essential to consider the risks associated with instant payout technologies. One primary concern is the security of sensitive financial data, as the rapid transfer of funds may expose users to cyber threats and fraud. Furthermore, some services may involve fees that could diminish the financial benefits of using instant payouts. Additionally, over-reliance on immediate access to funds may lead individuals and businesses to mismanage their finances, impacting long-term financial health. To navigate these challenges, it is crucial to choose reputable service providers and implement best practices in financial management.

What You Need to Know About the Future of Instant Payments

The future of instant payments is set to revolutionize the way transactions are conducted in our increasingly digital world. As consumers demand greater efficiency, financial institutions are rapidly adapting by integrating advanced technologies such as blockchain and artificial intelligence. According to a recent report, the global instant payments market is anticipated to grow at an impressive rate, driven by innovations in payment processing and the proliferation of mobile wallets. This surge in demand for seamless, real-time monetary transfers is not just a trend; it's a paradigm shift that is reshaping the financial landscape.

One of the most significant changes on the horizon is the rise of contactless payments and peer-to-peer payment systems, which enable users to send and receive funds instantly via their smartphones. Moreover, regulatory bodies worldwide are beginning to endorse frameworks that encourage instant payment solutions, leading to improved interoperability and greater consumer confidence. As we move towards a cashless society, businesses and individuals alike must stay informed about these developments to leverage the advantages of modern payment technologies effectively.